Do you really know what you’re eating?

Using data to improve transparency and traceability: A case study from the food sector

Supply chain transparency and traceability is increasingly becoming an imperative for producers of fast moving consumer goods. But what approaches are working for creating value from this process, rather than just sinking costs? Dr Mukesh Kumar and Rob Glew from the IfM’s Industrial Resilience Research Group share insights into a recent IfM collaboration with citrus fruit suppliers AMT Fresh, a company which has successfully implemented data-driven transparency and traceability systems with dramatic benefits for its revenue as well as positive outcomes for its partners up and down the supply chain.

In 2013 the ‘horse meat scandal’ hit parts of Europe, with the revelation that horse meat—and other undeclared ingredients including pork—had been found in mislabelled processed ‘beef’ products. The controversy caused a consumer outcry, and resulted in an increased focus on standards and transparency by food safety authorities across a number of countries, as well as a negative impact on customer trust for food producers and retailers.

Alongside the fallout from this scandal, an increasing focus on environmental sustainability has led to mounting consumer pressure for traceability across supply chains, with greater public demand for food retailers to provide clear, transparent information about the provenance of the products we consume.

In turn, the need to rebuild consumer trust has driven many of the large supermarkets and retailers to demand higher standards from their suppliers. This has in some cases included the demand for complete transparency, with suppliers being asked to open their books. For suppliers, this presents more than a simple request; it entails significant work and investment, both in terms of technological solutions and working practices.

So how can a supplier turn this cumbersome requirement into an opportunity? What strategies have successful suppliers adopted to move beyond the necessity for transparency just being an expensive burden, and instead learned how to create value from their data?

AMT Fresh: Remodelling as an information provider?

One firm that has embraced a simple, profit-maximising approach to supply chain traceability and transparency is AMT Fresh. Based in Newmarket, Suffolk, the company is one of the UK’s largest citrus specialists. Working in close partnership with a major UK supermarket, AMT Fresh operates in a fresh fruit and vegetables supply network with over 250 growers across Europe, Asia, Africa and South America to supply 11 million boxes of citrus (including clementines, satsumas, mandarins and oranges) each year.

When their key retail client introduced the requirement for suppliers to share open-book, fully transparent processes, AMT Fresh was faced with a daunting and potentially enormously costly hurdle. But managers realised that the new requirements could be turned to their advantage by using them to address some key challenges of fresh fruit supply.

The citrus fruit supply chain is characterised by particular issues: competition is high; forecasting is difficult and often results in supply surplus or shortage; quality can vary through the year, and there is not always a clear link between cost and quality. Decision makers at AMT Fresh realised that gathering, analysing and using data from increased supply chain transparency could give them better information to support forecasting and pricing accuracy, as well as to reduce waste by better understanding supply levels.

Naomi Pendleton, Head of Technical at the company, was tasked with building a traceability system on a tight budget. Impressively, she developed a bespoke system for less than £20k, which provides a very detailed view of traceability in ethical labour. AMT have also developed data-driven capabilities for reducing food waste, and for better forecasting which has enabled improved information for quality control and pricing.

IfM researchers worked with AMT Fresh to assess the effectiveness of the new systems. We collected and analysed the data, then identified the value propositions through interviews and observations.

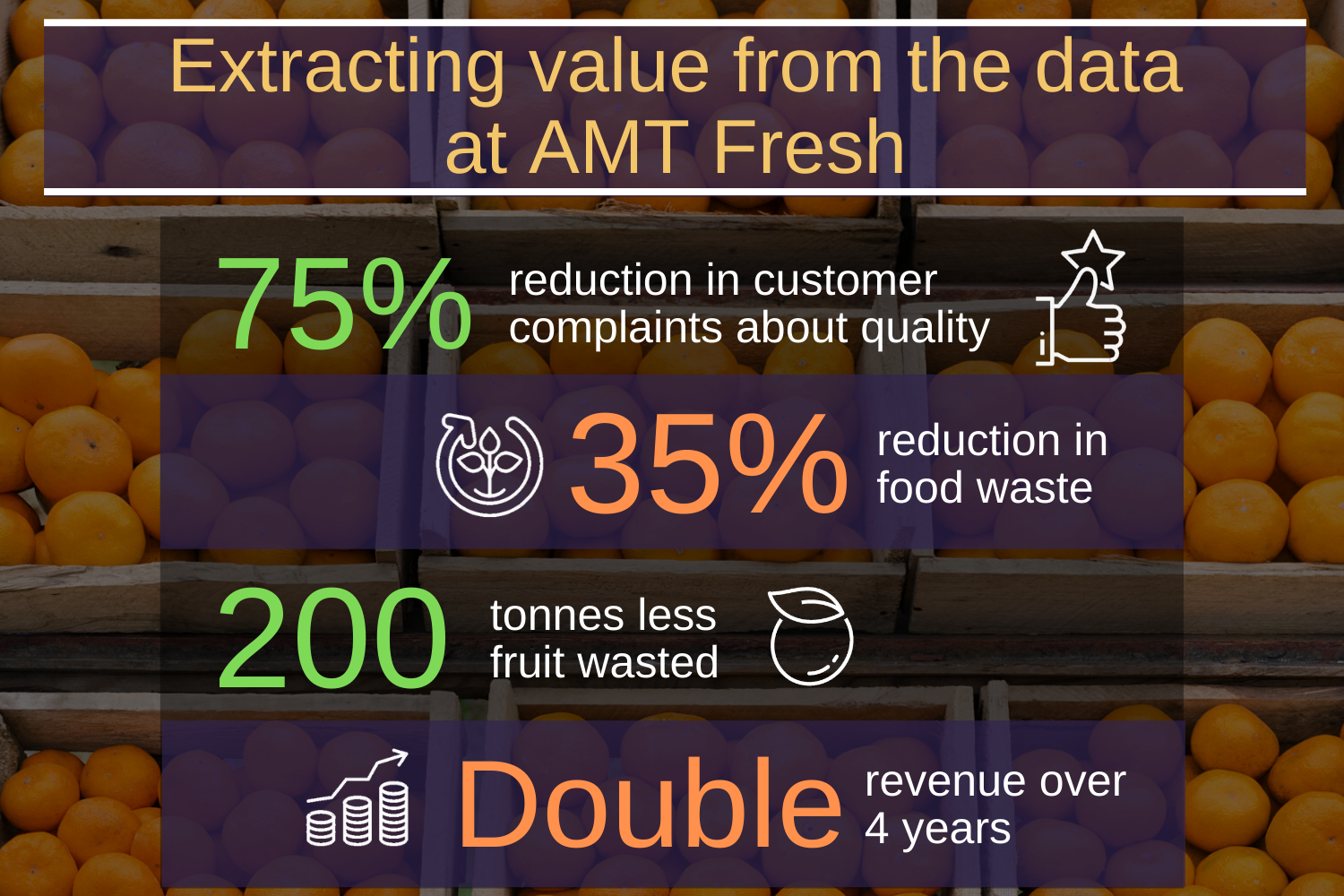

AMT Fresh’s initiatives have multiple benefits, as the IfM’s analysis helped to reveal:

- Quality control: Sharing detailed product quality information with suppliers and farmers has enabled them to develop a deep understanding of fundamental causes of quality issues.

- Customer satisfaction: Fruit are split into different high, middle and low market product lines depending on their quality characteristics, with the new quality data from traceability and transparency allowing AMT and their supermarket client to make better categorisation decisions. The result has been a 75% reduction in customer complaints related to product quality since 2014, when the system was first rolled out.

- Optimised pricing: Data from farmers has helped to optimise AMT’s sourcing strategy. The information can then also be shared with AMT’s supermarket client, and used to improve pricing – more carefully defining the quality specifications for their different price levels of citrus fruit.

- Better forecasting: There is more readily available data on crop size and quality from farmers, improving the accuracy of forecasting.

- Ethical working practices in the supply chain: AMT has been able to insist on strict standards for ethical labour across their supply chain. Farmers and fruitpackers who do not conform can be quickly identified and dropped, leaving no room for violations and reducing the risk of political fallout to AMT Fresh and their customers.

- Reducing food waste: No less impressive is the benefit to the environment from AMT’s data-driven tactical decisions. Food waste has become a major public issue as consumers push firms to be more sustainable. In the four years since the new system was deployed, AMT has reduced food waste by 35%. In real terms, this means 200 tonnes less fruit is going to waste.

Across the whole business, AMT Fresh has seen revenues double between 2014 and 2018. This is particularly impressive when supermarkets—at the retail end of the supply chain—are seeing revenues plateau or even fall.

The success of AMT Fresh exemplifies what is possible where firms build traceability and transparency systems with a clear and proven business case in mind, carefully manage the volume of information in the system, and use it to drive tactical decision making.

Understanding how to extract the value from its data has proved beneficial not only to AMT Fresh itself, but also to its key client supermarket, which is able to improve pricing, reduce waste and increase customer satisfaction. It is also benefiting all the suppliers and farmers further up the supply chain, who are able to secure more certainty about the prices they will receive for fruit, reduce waste, and strengthen their position as ethical suppliers.

As such, the value of AMT’s role in the supply chain has evolved into being an information provider in addition to the traditional role of supply chain wholesaler intermediary.

The business case for supply chain traceability: 10 value propositions

So to what extent is it becoming easier for companies to identify how to extract value from supply chain traceability data? In the past few years, there has been large investment across manufacturing, pharmaceutical and food industries in initiatives to improve supply chain traceability and transparency, with spending topping $10bn in 2017. Until recently, most initiatives have focused on regulatory compliance, such as chemical treatments in food supply chains, or on sustainability, such as the forestry commission scheme.

Decision makers are faced with difficult choices around justifying investment, as well as data interoperability and scalability, in designing and implementing these traceability systems. With the barriers to development often high, it’s vital that there is a clear business case for implementing systems to deliver traceability and transparency.

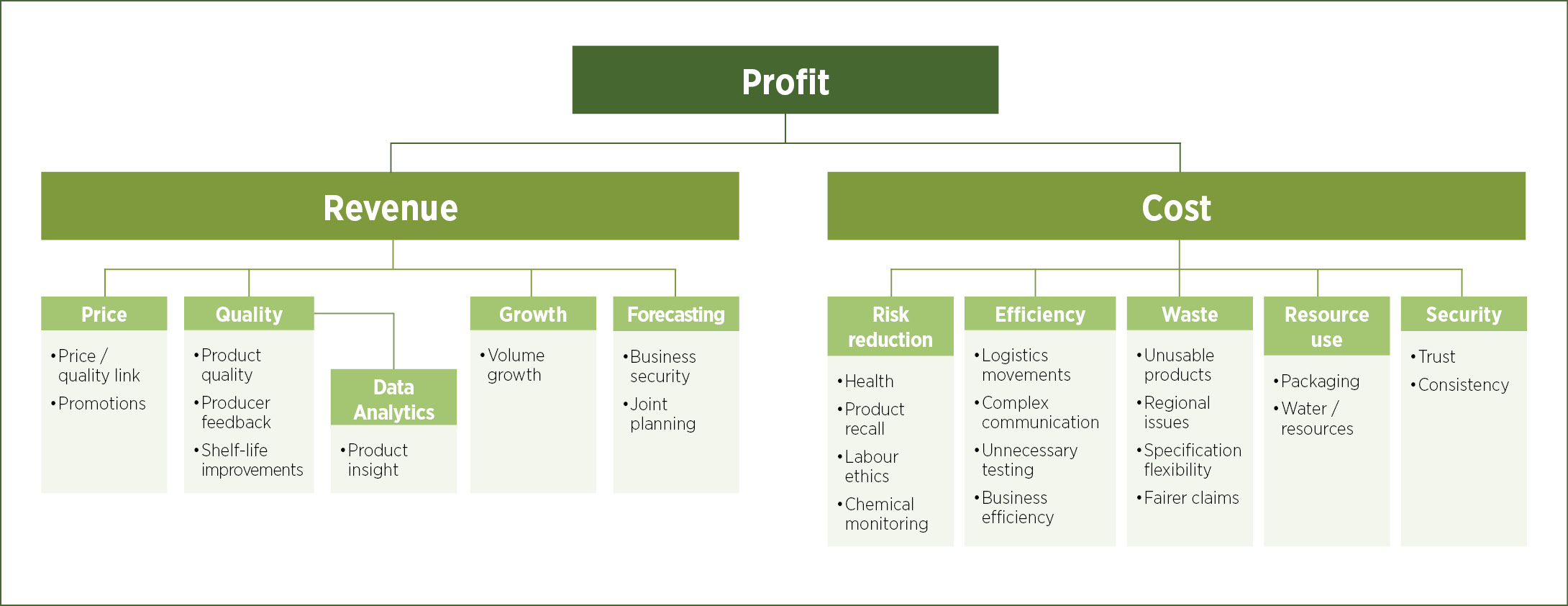

Recent research from the IfM’s Industrial Resilience Research Group has assessed the link between increased profits and supply chain traceability and transparency systems, by identifying business cases and linking them either to an associated reduction in cost, or to an increase in revenue.

Our analysis of AMT’s initiatives helped to highlight what the key lessons were that could be generalised for other practitioners. This can help other firms take deliberate steps towards maximising value based on the value propositions best suited to their supply chain.

We grouped the business cases around 10 wider value propositions, which translate across industries (see Figure 1). Firms should focus on which of those value propositions relate most closely to their strategic priorities. For example, companies in highly competitive markets with a high degree of product differentiation should use traceability to create a link between quality and price. But for firms producing standardised products, such as pharmaceuticals, it is more likely that risk reduction and security are higher importance.

Once managers have identified the business case that holds the most value for their firm, they are in the position to begin design of the system. Our research has identified that the format of data used in the system is the most critical design decision. Many of the companies we work with operate international, multi-tier supply chains that generate hundreds of thousands of data points for every product. Previously, the approach has been to collect all the available data in the belief that every data point has value. This led to sky-high costs to develop, use and maintain systems. Information overload can be avoided by identifying the few types of data that are relevant to each firm’s individual supply chain traceability business case.

Extending the use of data to strategic decision making

How businesses collect, manage and use information about their supply chain has a growing effect on the bottom line. At present, much of the focus has been on making improvements at the operational or

tactical layers of decision making. However, managers must develop capabilities to make use of this information in the board room, as well on the level of day-to-day operations. Addressing this, the next step for this research is to understand how the data produced from traceability can be bought into the strategic level of decision making. Does this information have value in supporting critical decisions such as where to open a new plant or where to source products from?

We are actively seeking industrial partners to work on this challenge with us. If you would like to know more about our work on industrial resilience, including data-driven approaches to strategic supply chain decisions, please contact Rob Glew, rg522@cam.ac.uk.

For further information please contact:

Dr Mukesh Kumar; Rob Glew