Making the shift to services

Professor Andy Neely, Director of the Cambridge Service Alliance and the Royal Academy of Engineering Professor of Complex Services at the University of Cambridge, reflects on some of the key trends in servitization and the strategic choices facing today’s manufacturers.

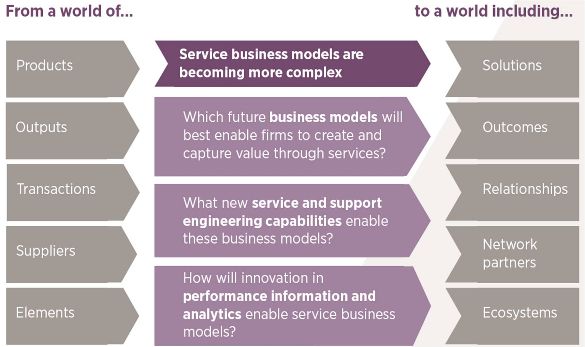

In recent years we have seen the emergence of five key trends underpinning the transition to more service-based business models. These trends can be characterised in terms of shifts: from a world of products to a world which includes solutions; from outputs to outcomes; from transactions to relationships; from suppliers to network partners; and from firms to ecosystems. This is not intended to suggest that solutions will replace products, or that relationships will replace transactions, but rather to highlight the fact that solutions are supplementing products, relationships are supplementing transactions, and so on.

Customers don’t want to buy a piece of hardware that they have to integrate with separate software and infrastructure. They want solutions that are ready to go.

The first trend – the shift from products to solutions – reinforces the fact that customers and consumers are increasingly interested in the solution provided, not just the product. This is particularly acute in the business-to-business and business-to-government arena, where customers are looking to their partners to provide integrated, often technology-enabled, solutions that meet their needs. Customers don’t want to buy a piece of hardware that they have to integrate with separate software and infrastructure. They want solutions that are ready to go.

A related shift is from output to outcomes. There are customers who want to ‘contract for outcomes’. They define the result they want and then ask a solutions’ provider to deliver it for them. In the UK, for example, the government has recently privatised some of its prisons. Included in the contract is an incentive scheme which means the providers are paid more if the reoffending rates of prisoners leaving their care are lower than the national average. The advantage of this approach is that the solutions’ provider and the customer share the same incentive – they both want to reduce reoffending rates among the prison population.

|

Professor Andy Neely |

Solutions’ providers who contract for outcomes often need to make significant investments in building the capability needed to deliver integrated solutions. This, coupled with the fact that risk is often transferred from customer to solutions’ provider, means that many of the outcome-based contracts are long term. Extended contract lifetimes are often needed to justify the investment required to establish the capability to deliver the solution. Hence, the third shift – from transactions to relationships. Increasingly, outcome-based contracts involve close and long-term working relations between customers and providers.

The fourth trend – from suppliers to network partners – arises from the complexity of some of the solutions. It is rare that a single firm has all of the capabilities needed to deliver complex services. In the UK defence industry, for example, BAE Systems runs Portsmouth naval base. It maintains and repairs ships, but as part of its contract with the Ministry of Defence, BAE Systems is also responsible for maintaining the physical infrastructure of the docks, and for providing support services for sailors and their families including accommodation, leisure facilities and catering. It also coordinates the entire fleet support programme. Some of these services are core to BAE Systems, but others – catering, for example – are not. BAE Systems, therefore, partners with other organisations to deliver specific elements of the service package. And it is not just non-core services that are outsourced by the prime contractor in complex services. Integrated solutions are often enabled by sophisticated technology and software infrastructures, including significant elements of data analytics. The prime contractor may well partner with specialist software developers and data analysts to deliver the service. The point is that we are increasingly seeing networks of organisations pooling their capabilities, rather than operating in the traditional buyer–supplier mode.

The graphic below describes the final shift as being ‘from elements to ecosystems’.

This transition is concerned with the changing nature of industrial competition. Instead of individual elements (in other words, firms) considering how they can compete with their direct competitors, they are making strategic choices to shape the ecosystem they operate within. Apple, for example, has opened up the technology for creating apps, which has encouraged lots of people to become apps’ developers. Yet Apple still owns the platform – the hardware and the App Store – which allows users to access the apps. By encouraging the proliferation of apps’ developers, Apple creates competition in one part of the ecosystem.

This intense competition makes it difficult for the developers to charge very much for their apps, which means that Apple consumers can access a wide range of low-priced apps through the Apple platform. The wide range of apps is of value to Apple consumers who, in turn, are willing to pay high prices for the Apple-designed hardware needed to access the apps. So by creating competition in one part of the ecosystem, Apple has managed to create additional value for the users of their products, which in turn increases consumer loyalty to the Apple range. Across many industries the competitive choices are now not simply about how firms compete with their direct competitors; what matters is how they seek to shape the industrial ecosystem to their advantage.

These five trends underpin the strategic choices manufacturers need to make about the kind of service provider they should become. One of the questions they must ask themselves is: where does value lie and when is it realised? In traditional manufacturing, the value lies in products and parts – the physical assets – and value is realised at the point of sale, when the customer pays for the product. Many manufacturers, particularly those who make products with long life-cycles, have recognised that value can also be realised throughout the life of a product, especially when products need repair and overhaul. Such firms have a strong focus on the ‘aftermarket’, and derive significant value from the sales of ‘spares and repairs’.

Another approach is to embrace the trend from products to solutions, putting the emphasis on the outcomes the customer wants, rather than on the physical product. The old Theodore Levitt quote “customers don’t want quarter-inch drills, they want quarter-inch holes” illustrates the point. Many customers don’t want to own the physical products that manufacturers provide – they just want the end result (or the outcome) that the product delivers. When manufacturing firms become more focused on outcomes they often ‘contract for capability’, guaranteeing uptime and/or the availability of their equipment through life. Rolls-Royce, in its aero-engine business, contracts for Power-by-the-Hour, effectively selling the thrust the engines deliver rather than the engines themselves. A significant advantage of contracting for capability is that the incentives of the customers and the original equipment manufacturers are aligned. If companies are deriving significant income from ‘spares and repairs’, it suits them if the equipment breaks down. When contracting for capability or outcomes, however, the manufacturer gets paid only when their equipment is working, so it is in their interest to make their equipment as reliable as possible – which also suits their customers.

|

Find out moreThe Alliance publishes a wide range of reports, working papers, executive briefings, case studies, videos and podcasts on service-related topics. Find out more here. |

One of the challenges of contracting for capability, however, is the issue of risk. If manufacturers take responsibility for the outcomes their products deliver – effectively guaranteeing results for their customers – they are taking on significant risk. Some servitizing manufacturers have decided that the risk is too great. Equally, some customers have decided they don’t want to relinquish control over outcomes to a third-party, so prefer not to enter into this kind of contract.

There is also a third way: selling knowledge and insight, recognising that value lies in the solution the original equipment manufacturer offers. Think here of manufacturers who offer design and development or installation advice. Think of those who have moved into training and consultancy services. They no longer simply sell products. They also sell knowledge and insight.

So manufacturers who are considering the shift to services have three broad strategic choices to make: whether to focus on the aftermarket or on delivering outcomes or on supplying knowledge. These choices, however, are not mutually exclusive. Manufacturers can decide, for example, to focus both on the aftermarket and on knowledge support, although clearly the different positions will require different organisational capabilities.

These trends and choices can have profound consequences for manufacturing firms. And, of course, profound change results in significant challenge. Not all firms find it easy to make the shift to services and this is one of the reasons why the Cambridge Service Alliance was established. Working with our partners, BAE Systems, Caterpillar, GEA, IBM, Pearson and Zoetis, we are actively exploring how firms can successfully make the shift to services, by innovating their business model, building the right organisational capabilities and exploiting the power of data, information and technology.