Reports and articles

The practical impact of digital manufacturing

Published on July 25th 2019

Is it possible to identify a real economic impact resulting from the ‘digital revolution’ in manufacturing? Governments in a number of countries have made efforts to boost their national economies through investment in digital manufacturing. But is there yet evidence of any resulting upturn in productivity, gross value added, or employment?

A recent study for the UK government by leading Cambridge academics indicates grounds for optimism. Indeed, the findings provided key evidence for £120 million funding boost announced by the government in late 2018. Dr Carlos López-Gómez, Head of the IfM’s Policy Links Unit, explains more…

Over the last few years, there have been many predictions made about the potential impact of the digital revolution on manufacturing and the wider economy. The forecasts point to a potentially disruptive effect of digital technologies across all aspects of industries – from the way in which products are made, the types of jobs manufacturers are able to provide, and the functionalities offered by digitally enabled products and services.

In keeping with this outlook, the Made Smarter Review for the UK government in 2017 projected that the adoption of digital technologies in UK industry could lead to a 25% increase in productivity by 2025.

But can we yet point to evidence of impact that companies can relate to? Innovate UK (IUK) recently commissioned the Policy Links Unit and senior academics at the Institute for Manufacturing, University of Cambridge to evaluate the evidence on the impact of digital manufacturing. The resulting report, The Practical Impact of Digital Manufacturing: Results From Recent International Experience, analyses how digitalisation technologies are actually being deployed in key manufacturing countries, and the results for the firms deploying them. The aim was to identify both expected and observed results of digitalisation in manufacturing, drawing on examples from around the globe.

IUK’s primary objective was to build the evidence base to inform investments in digital manufacturing technologies under Wave 3 of the government’s Industrial Strategy Challenge Fund – part of government’s Industrial Strategy, the long-term plan to raise productivity and earning power in the UK. The UK government has made a commitment to increase funding in research and development by £4.7 billion over 4 years to strengthen science and business nationally.

The predicted impact

National governments have attempted to estimate for the expected economic impact of digitalisation on manufacturing, using national-level indicators such as productivity, value added and jobs.

- Value added: The most common indicator used in the sample of countries surveyed is value added. Estimates vary significantly, reflecting differences between the size of national economies (for example, Germany predicted €425 billion value added compared to Canada’s €22.6 billion), but it should be noted that these figures very much reflect differences in the sizes of the national economies.

- Productivity: Germany’s government has estimated productivity gains of up to 30% by 2025, and Singapore has estimated a 30% improvement by 2024. In Japan, the government estimates that growth in labour productivity in manufacturing could be increased by more than 2% annually, citing as a key driver an expected doubling of robot use by 2020.

- Jobs: Despite common perceptions about the potential negative impact of digitalisation on jobs, all estimations identified forecast that digitalising industry will also lead to the creation of new jobs. Spain estimated 1.25 million new jobs would be created over five years.

- Qualitative measures are also regularly cited by governments, including benefits to competitiveness, business confidence, and sustainability.

However, these evaluations have so far been almost entirely focused on future predictions, with attempts to quantify the expected impact of digital adoption, mainly based on rough macroeconomic extrapolations and survey data.

Very few countries have published data on real (observed) impact of digitalisation across their national economies. Singapore and Korea are notable exceptions – both reporting the same level of improvements in manufacturing efficiency in firms (around 30%). In Korea, systematic efforts have been made to evaluate the firm-level impacts of digital adoption on over 3,000 firms supported by a major national programme, the Korea Smart Manufacturing Initiative.

Policymakers making investment decisions are better equipped if they can refer to actual evidence of observed impact alongside projections. But so far there has been a lack of availability and analysis of such evidence.

For IUK, making the case for investment from the Industrial Strategy Challenge Fund to be put into digitalisation of manufacturing required evidence-based research to unpick how the digital revolution is playing out in the major manufacturing economies. IUK also wanted to understand if there are lessons the UK can learn from other countries, and the types of digital transformation initiatives that are likely to deliver impact.

This required deeper investigation into the manufacturing activity at company level.

The observed impact

To do this, the team developed a common framework to collate and compare data from across different countries and different types of organisations. This was no small feat, given the variety of terminology used and lack of commonality in how impact and productivity are measured.

The study also identified which activities are being prioritised for digitalisation investments by manufacturing firms, and where the business value is being created.

Much of the data was drawn from small and medium size enterprises (SMEs), which is the focus of the majority of funding initiatives worldwide. The richest sources of data were from key manufacturing countries such as China, France, Germany, Korea, Japan, Singapore, the US and Canada.

The team identified over 1,000 use cases from across these economies, and selected 200 companies (all participating in government-backed initiatives supporting digitalisation) for closer study. In each of these 200 cases, the team examined the business areas being prioritised, the types of digital applications companies were using, and the benefit they reported from digital adoption.

Where are manufacturing firms using digital technologies?

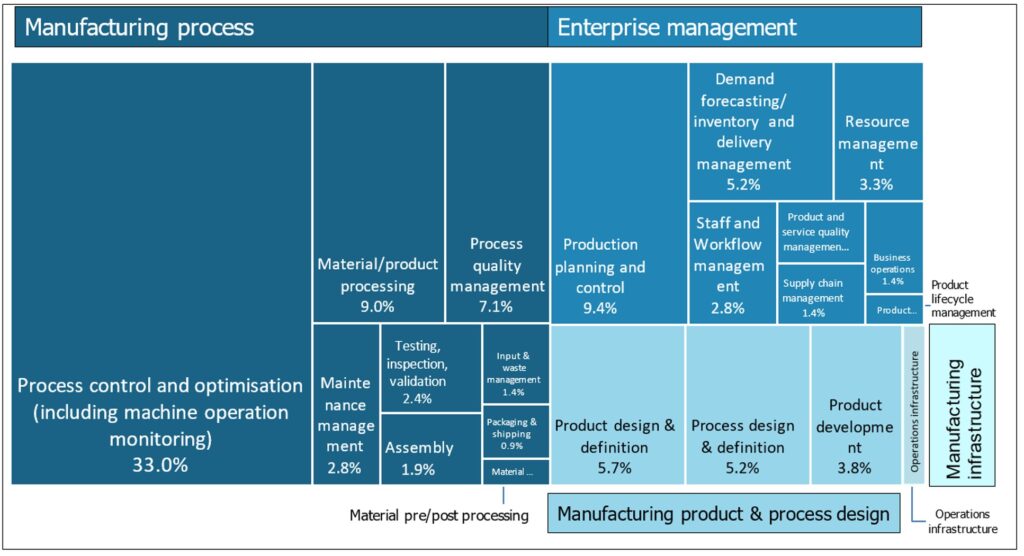

Digital applications and solutions were classified according to the functional areas where they were deployed, as shown in the figure:

- ~ 33% of the cases were prioritising digitalisation to support process control & optimisation

- ~ 9.4% to support production planning & control

- ~ 9% to support material/product processing

- ~ 7.1% to support process quality management

- ~ 5.7% to support product design & definition

Where are firms getting the most value from digitalisation?

The team then analysed the impact reported by firms from their digital investments, across various measures of business value.

The top five business areas benefitting most from digital initiatives include:

- Reduction in labour costs (median >55% improvement)

- Reduction in defects and costs (median >45% improvement)

- Reduction in material costs (median >45% improvement)

- Increase in outputs (median >30% improvement)

- Improvements in delivery and service performance (median >30% improvement)

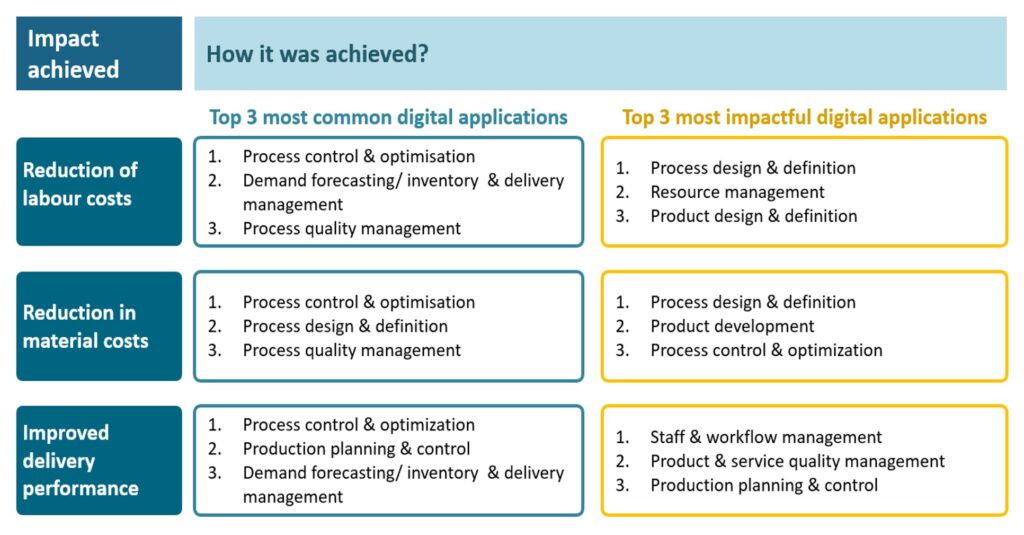

Interestingly, however, the evidence shows that the applications where most companies focused their digitalisation efforts are not necessarily those that delivered the most benefit. For example, companies that reported a reduction of costs were most likely to be using digital applications focused on process control and optimisation (Figure 2). However, the impact was bigger when they used applications aimed at improving process design and definition.

Figure 2: The most popular digital application is not always the most valuable

Five strategic insights

The analysis in the report enables a number of insights which can inform strategic decision-making, both for firms and for policymakers. Five key insights are:

- Supply chain-level opportunity: We found that most digitalisation implementation projects are focused within one company, often with a single application, and very few encompass supply chains or networks of companies. The value of achieving digitalisation across supply chains is therefore not yet being exploited. The success of such supply chain digitalisation projects is likely to depend on support being offered to SMEs to make the costs and uncertainty manageable. The international experience suggests that this can be enabled through support from both government initiatives and larger supply chain partners.

- Information for selecting priorities: We also found that the areas prioritised for digitalisation are not necessarily the same as the areas that can deliver most business benefit to organisations. There is a dominant focus on production processes and lines. As more evidence becomes available, it should become easier for more informed decisions to be made. This include better understanding of which digital applications are more relevant to different sectors.

- More than just technology: Looking at how technologies actually find their way into firms’ operations is vital for achieving effective digitalisation. However, we found that often technologies are seen as the end in itself. The technical, managerial and contractual barriers that firms face to gain value from them often come as an afterthought. Considering these aspects early in the design of support programmes is critical to ensuring their effectiveness.

- Implementation lessons: The report also provides insights into implementation strategy. The team looked at digitalisation initiatives in other countries, and talked to people leading them, to better understand the practical considerations for successful investment programmes. National roll-out efforts in the UK could benefit from better understanding effective practices (and pitfalls) from the international practice.

- The unique UK opportunity: For the UK, there are a number of strategic considerations, such as where investment could help the UK genuinely gain a competitive advantage. The report provides insights for UK policymakers into opportunities to go beyond just direct comparisons with other national economies, and to think about how the UK can differentiate itself.

The evidence gathered provided IUK with key evidence for inclusion in their business case, which was successfully awarded £120 million investment for ‘Made Smarter’, announced in autumn 2018.

For further information please contact:

Ella Whellams

+44 (0) 1223 748262erd30@cam.ac.ukDownload the report

The Practical Impact of Digital Manufacturing: Results From Recent International Experience, was commissioned by Innovate UK and written by the Policy Links Unit at the Institute for Manufacturing, University of Cambridge, led by Dr Carlos López-Gómez, with contributions from leading academic experts in digital manufacturing and policy, including Professor Duncan McFarlane, Dr Eoin O’Sullivan and Dr Chander Velu.

Related resources